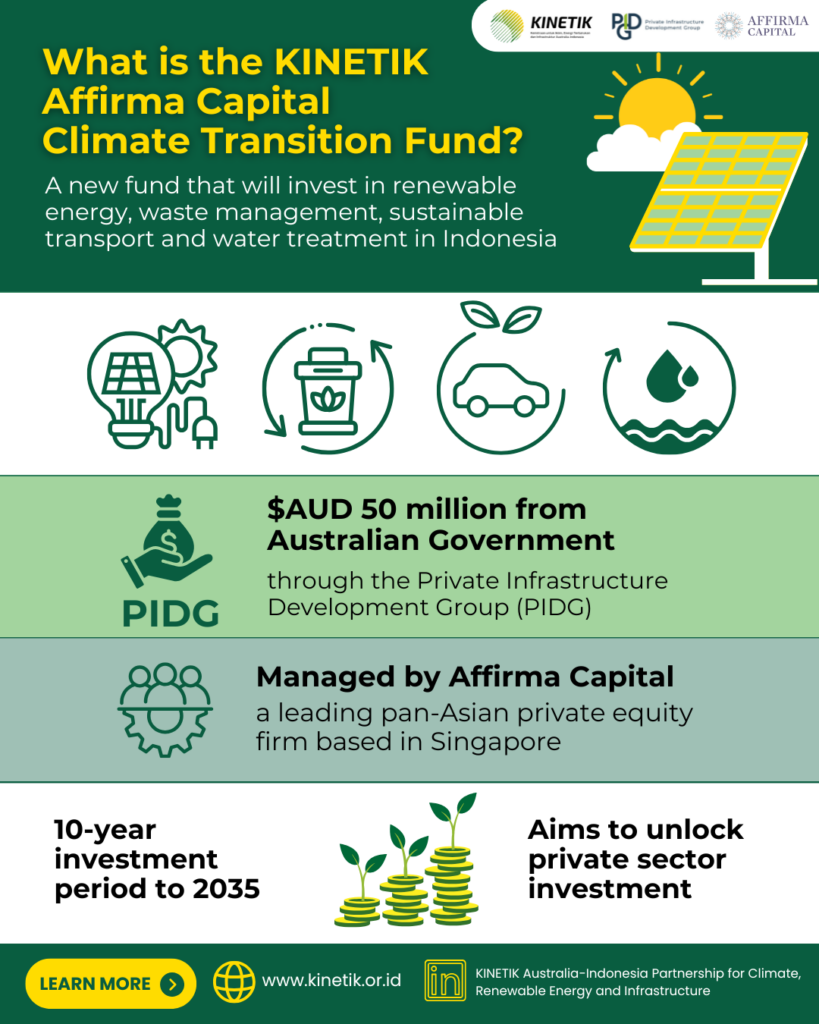

A new climate-focused fund that will invest in renewable energy, waste and sustainable transport in Indonesia was launched by Australian Ambassador Rod Brazier on July 1.

The Australian Government has committed a cornerstone investment of $AUD50 million to the fund through the Private Infrastructure Development Group (PIDG), a multilateral infrastructure project developer and investor.

The fund – named the KINETIK Affirma Capital Climate Transition Fund – will be managed by Affirma Capital, a leading pan-Asian private equity firm based in Singapore.

Australia’s contribution will drive investment in climate-related projects and attract additional financing from the private sector.

The KINETIK Fund – which supports Indonesia’s goal of reaching net-zero emissions by 2060 or earlier – will invest in areas such as clean energy, recycling and waste management, water treatment and reuse and sustainable transport and logistics.

Examples of early potential investments include hydropower assets and industrial scale solar.

The KINETIK Fund – which is expected to attract other investors – will begin in the second half of 2025 with a 10-year investment period to 2035.

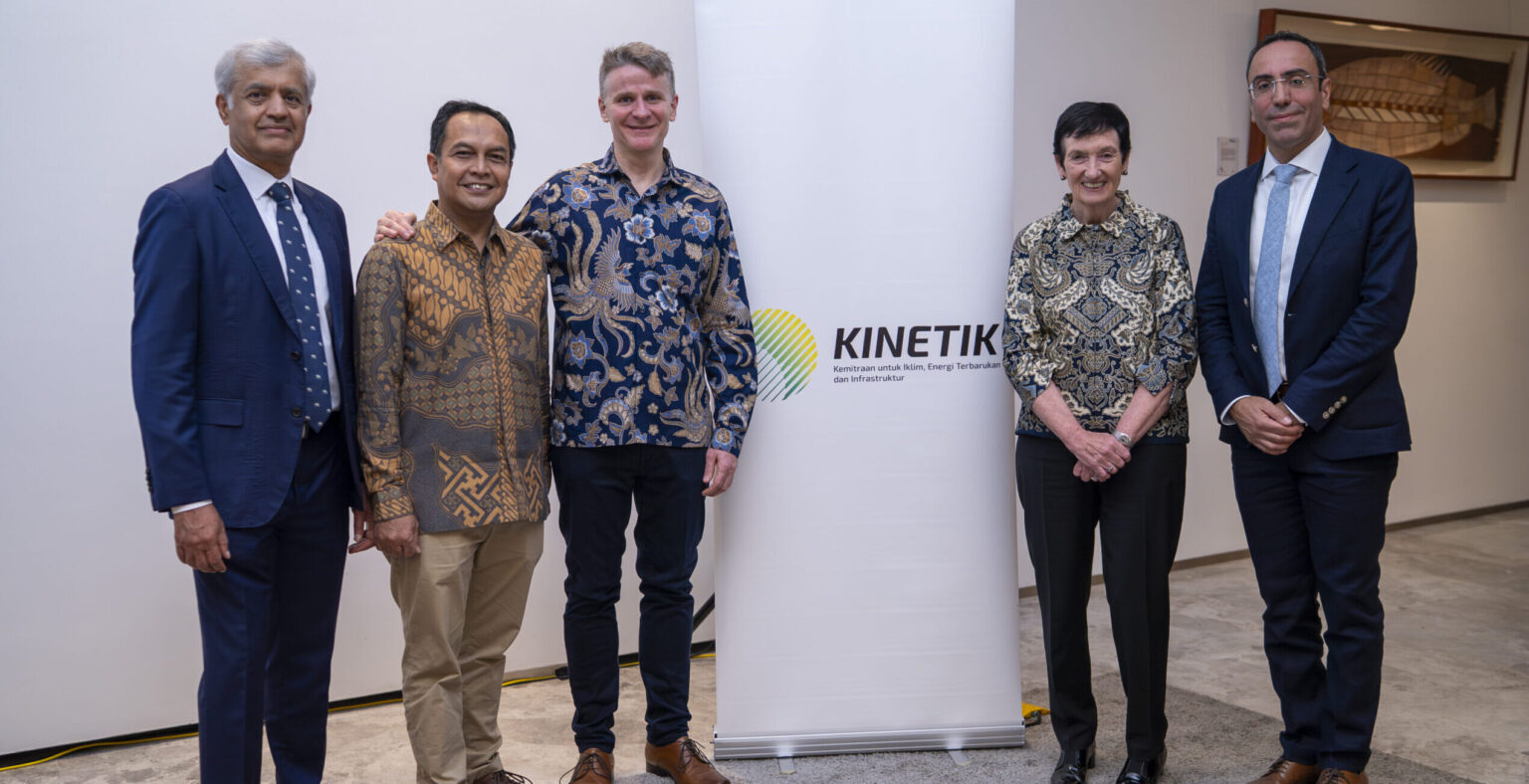

Ambassador Brazier said Australia was committed to supporting the economic opportunities in Indonesia’s transition to renewable energy.

“Through the KINETIK Fund, we’re helping to unlock capital for companies that reduce emissions, grow green investments and build a more resilient low-carbon economy,” he said.

Australian Ambassador to Indonesia Rod Brazier. Photo: JEFRI TARIGAN

Boby Wahyu Hernawan, Director of Multilateral Cooperation and Sustainable Finance of the Ministry of Finance, said that for Indonesia, the energy transition was not just about climate – it was about macroeconomic stability.

Global energy price fluctuations directly impact Rupiah stability, state budget efficiency, and household resilience.

“The numbers don’t lie. Every dollar we fail to invest today will cost us a lot more tomorrow in disaster recovery and economic instability,” Mr Boby said.

Mr Boby said the launch of the KINETIK Fund showed how global knowledge and local action can work together.

“With PIDG and the $50 million Australian dollar investment, we are not just funding projects. Successful delivery of this commitment would showcase that climate finance can be bankable, scalable and inclusive,” he said.

“Let us remember that Indonesia and Australia do not just participate in the global climate conversation – we help to shape it.”

Boby Wahyu Hernawan, Director of Multilateral Cooperation and Sustainable Finance of the Ministry of Finance. Photo: JEFRI TARIGAN

Australia’s Business Champion to Indonesia, Professor Jennifer Westacott invited institutional investors, infrastructure specialists, and private equity firms – including those in Australia – to seize this opportunity.

“The fund combines scale, impact and commercial potential, a powerful combination for investors looking to align returns with climate and development outcomes,” Professor Westacott said.

“That’s why I’m looking forward to going back to Australia and discussing this fund in the boardrooms of Australia, not just as a compelling investment case, but as a model for the kind of partnerships we need to meet our shared climate goals.”

Besides investing in the fund, PIDG will work with Affirma Capital to help assess and recommend how each of the proposed investments further the KINETIK Fund’s climate transition goals, align with best practices in health, safety, environment, and generate positive social impacts.

PIDG Chief Sustainable Impact Officer Marco Serena. Photo: JEFRI TARIGAN

The investment builds on PIDG’s previous commitments to bolster renewable energy production in Indonesia as well as ongoing efforts to mobilise private investment into sustainable domestic infrastructure sectors.

“PIDG has a strong commitment to scaling sustainable investments in support of Indonesia’s goal of achieving net-zero emissions before 2060”, said PIDG Chief Sustainable Impact Officer Marco Serena.

Winston Mandrawa, the Managing Director and Head of Southeast Asia at Affirma Capital, said the private equity firm was excited to embark on this partnership to unlock the return potential of Indonesia’s climate transition journey.

“Together, we aim to build a robust ecosystem and catalyse investment interest and participation in decisions that directly impact 280 million lives,” he said.